What happens when you ask ChatGPT which bank to choose? I spent a weekend finding out—and the results surprised me.

As AI-powered search replaces traditional Google queries, a critical question emerged: Which brands actually appear in AI recommendations?

I started noticing a pattern. When people asked ChatGPT for bank recommendations, certain names appeared repeatedly. Others—including well-funded neobanks and established regional players—were conspicuously absent.

This wasn’t just interesting. It was a preview of how customer acquisition is fundamentally changing.

So I built Knownful.com — a platform dedicated to tracking brand visibility across AI models.

This case study represents the first comprehensive analysis using our methodology.

The research

I developed a systematic approach to monitor AI brand mentions at scale, Knownful.com, then applied it to the American banking sector as our inaugural deep dive.

The scope and methodology:

- 48 banks, neobanks and fintechs (from Chase to Revolut). Full list is available here: Banking-Brands.xlsx

- 140 high-competition banking keywords (representing 287,380 monthly searches on Google) such as:

- “open bank account online”,

- “best bank”,

- “best online bank”,

- “best business bank accounts“,

- “what do you need to open a bank account“,

- “best bank for checking account“,

- “best bank for small business“,

- “best bank cd rates“,

- etc…

- Clustered these high-competition keywords into 13 main categories. Categories available here: Banking-Clusters.xlsx

- 2,019 AI-generated mentions analyzed.

- 430 source URLs analyzed

- 93 source websites analyzed

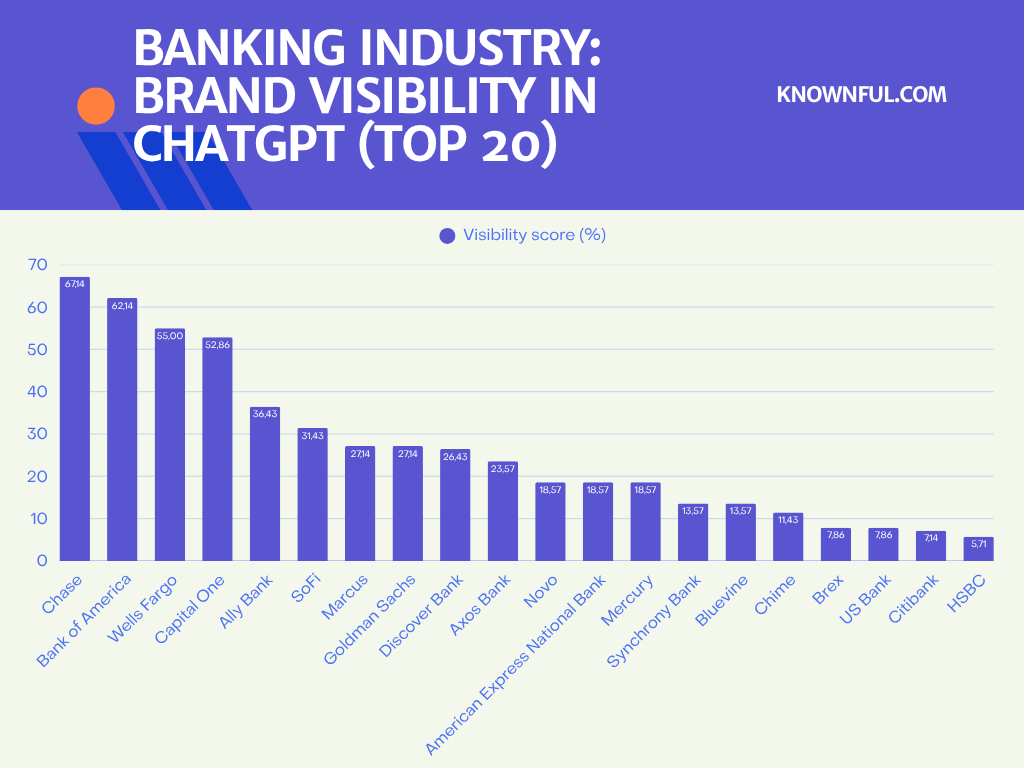

- The visibility score represents the percentage of queries in which a brand was mentioned. For example, if Chase appeared in 94 out of 140 queries, its visibility score is 67.14% (94 ÷ 140 × 100).

These weren’t random queries—I selected some of the most competitive search queries in the banking sector, the ones that drive actual customer acquisition.

The question: Which banks win ChatGPT’s recommendations for the searches worth millions in customer acquisition?

The four numbers that matter

After analyzing 2,019 AI-generated mentions across 48 brands, four key metrics emerged:

67.14% — Chase’s AI visibility score. It appears in 94 out of 140 banking queries—establishing near-monopoly status in AI recommendations.

27% — The percentage of banks with zero AI visibility. 13 out of 48 institutions don’t exist in AI’s understanding of the banking landscape.

28.86% — The visibility gap between traditional banks and neobanks. Despite being “digital natives,” neobanks have half the AI presence of legacy institutions.

34% — The market share controlled by two websites. NerdWallet and Bankrate dominate AI’s source material for banking recommendations.

These aren’t just statistics—they’re signals of a massive shift in how brands get discovered.

Finding #1: Chase is the clear winner when it comes to visibility

The data reveals a stark concentration at the top. Chase dominates with 67.14% visibility, followed by Bank of America at 62.14% and Wells Fargo at 55%. Capital One rounds out the top four at 52.86%.

The visibility gap is noticeable, and counterintuitive

Here’s what jumps out immediately: the top four are all traditional banks.

Despite neobanks positioning themselves as “digital natives” and “built for the internet age,” they’re nowhere near the top.

Indeed, the highest-ranked neobank, SoFi, sits at position #6 with just 31.43% visibility—nearly half of Chase’s score. Moreover, N26 and Revolut are not part of the TOP 20 with 2.86% for Revolut and 1.46% visibility for N26.

The drop-off after the top tier is steep. By position #5, visibility has fallen by nearly half compared to Chase. The middle tier—including digital players like Marcus (27.14%) —clusters around 25-30% visibility, significantly trailing the traditional banking giants.

The bottom half tells an even more concerning story. Banks ranked 11-20 struggle to break 20% visibility, with most hovering between 7-18%. At the tail end, even major institutions like US Bank (7.86%), Citibank (7.14%), and HSBC (5.71%) barely register—despite having billions in assets and millions of customers.

So the #1 insight is that the top 4 traditional banks capture the majority of AI recommendations, while digital-native challengers and regional players fight for the margins.

Interested in understanding your brand’s AI visibility compared to competitors? I can provide a complete private audit with visibility data, competitive analysis, and a personalized 10-minute video breakdown. Contact me →

Finding #2: category winners and where different strategies win

The aggregate numbers tell one story. But category-level data reveals where different banking models succeed—and where traditional dominance breaks down.

Categories where neobanks and specialists lead

Online banking: digital-first players dominate

- SoFi — 90.91% of visibility

- Capital One — 81.82% of visibility

- Ally Bank — 81.82% of visibility

The only major category where neobanks achieve parity with—or exceed—traditional banks. Traditional giants like Chase and Bank of America drop to 27% visibility here.

Savings accounts: high-yield specialists win

- Goldman Sachs — 83.33% of visibility

- Marcus by Goldman Sachs — 83.33% of visibility

- Ally Bank — 83.33% of visibility

Four-way tie among banks known for high-yield products. Traditional checking-focused banks fall behind—Chase drops to 42%, Bank of America to 33%.

Interest rates & CDs: most distributed category

- Capital One — 36.36% of visibility

- Goldman Sachs — 36.36% of visibility

- Marcus — 36.36% of visibility

Six-way tie with no clear leader. Rate-focused queries favor online banks and high-yield specialists over traditional banks.

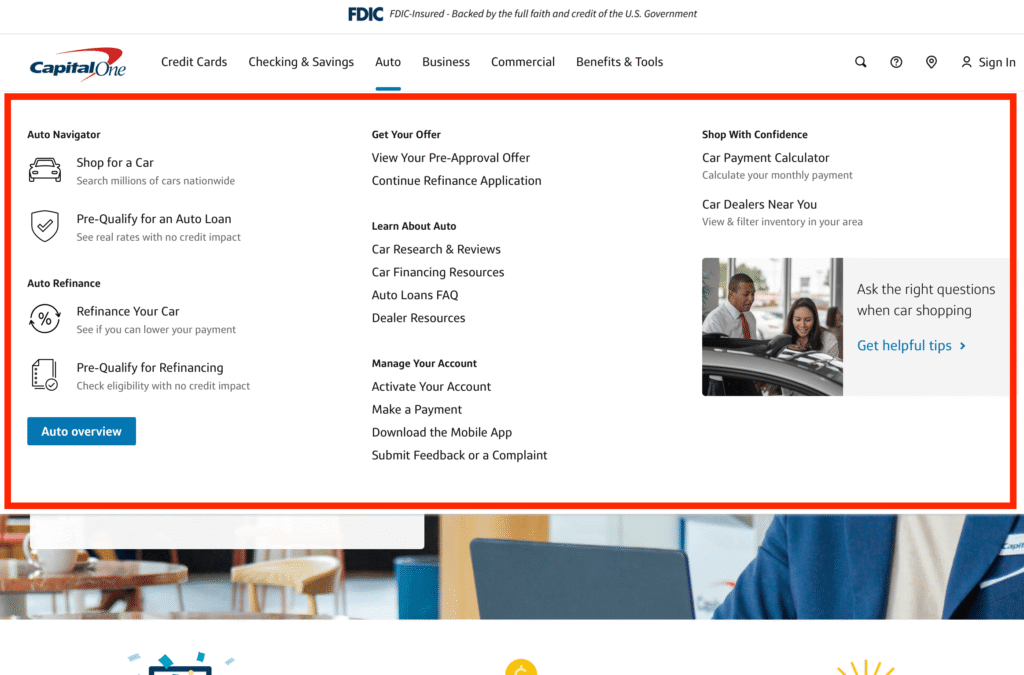

Auto loans: lending specialists win

- Capital One — 70.00%

- Wells Fargo — 50.00%

- Chase — 40.00%

Specialized auto lending expertise translates to AI visibility. Capital One’s decades of auto financing content creates clear differentiation (cf screenshot).

Personal Loans: lending-focused players dominate

- Wells Fargo — 100.00%

- Goldman Sachs — 100.00%

- Marcus — 100.00%

Four banks achieve perfect 100% visibility (including SoFi). All are known for strong personal lending programs—traditional or digital.

Categories where traditional banks lead

Business banking: traditional + specialized fintechs

- Chase — 96.43%

- Bank of America — 96.43%

- Mercury — 92.86%

Traditional banks dominate, but specialized business banking fintechs like Mercury achieve strong visibility despite being newer entrants.

Persona keywords: brand recognition matters

- Chase — 100.00%

- Bank of America — 100.00%

- Wells Fargo — 87.50%

Gateway products where brand awareness drives recommendations. Traditional banks with extensive student marketing programs lead.

Best general bank accounts: traditional banks win

- Chase — 85.00%

- Wells Fargo — 80.00%

- Bank of America — 75.00%

When queries are broad (“best bank”), traditional banks dominate. Established online banks (Ally, Discover at 70%) compete but trail the Big Three.

Checking accounts: mixed performance

- Chase — 80.00%

- Bank of America — 80.00%

- Capital One — 80.00%

Four-way tie (including Ally) shows that both traditional and established online banks can compete in mainstream checking. No clear model advantage.

Mortgage / home loans: traditional banks + SoFi

- Chase — 60.00%

- Bank of America — 60.00%

- Wells Fargo — 60.00%

Four-way tie at 60% (including SoFi). Traditional mortgage lenders tie with digital challenger.

Business loans: traditional banks Lead

- Chase — 70.00%

- Bank of America — 50.00%

- Wells Fargo — 50.00%

Traditional banks dominate business lending queries. Specialized fintech Bluevine appears at 30%.

Opening accounts: traditional banks win

- Chase — 85.71%

- Bank of America — 85.71%

- Wells Fargo — 71.43%

First-touch queries favor established brands. Online banks (Capital One, Ally at 71%) compete but trail.

Specific services: Capital One dominates

- Capital One — 100.00%

- Chase — 80.00%

- Bank of America — 40.00%

Capital One achieves perfect visibility for feature-focused queries (Zelle, mobile deposit, etc.) through heavy tech marketing.

If you’re leading marketing or growth at a bank and want to discuss strategies to improve your AI visibility, feel free to reach out.

Contact me →

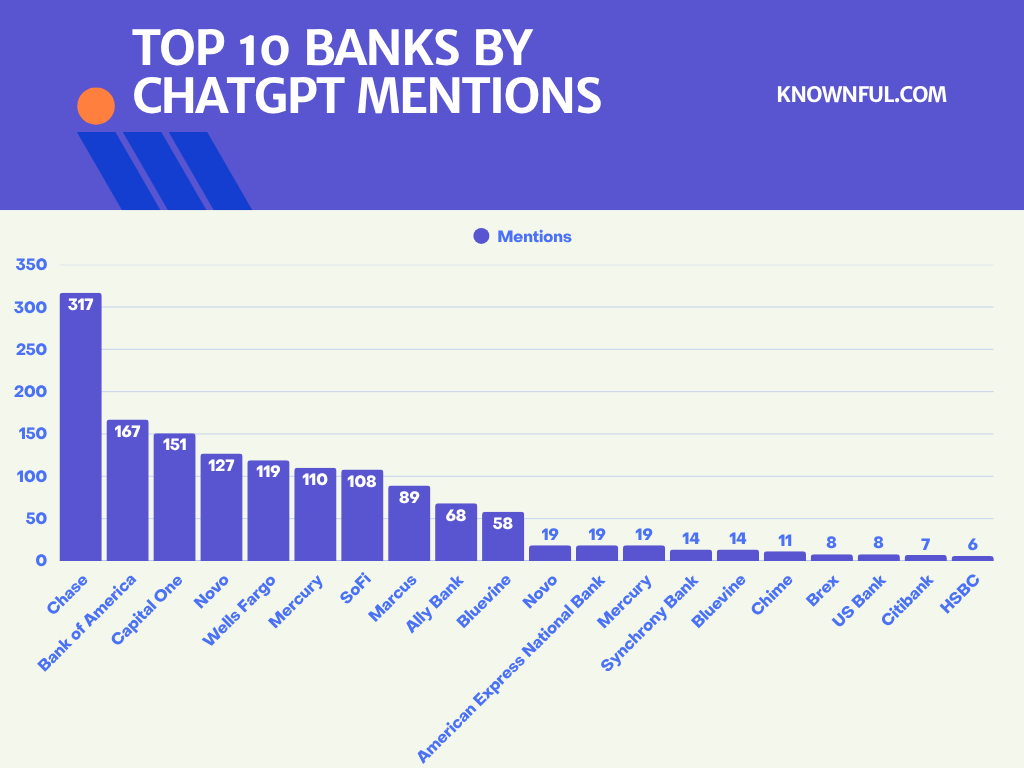

Finding #3: the Big 3 capture 30% of all brand mentions

The top 3 banks—Chase, Bank of America, and Wells Fargo—capture 30% of all brand mentions.

A third of the conversation.

I expected competition in the banking sector. What I didn’t expect was this level of concentration.

Let that sink in: 3 brands out of 48 (just 6.25%) represent close to a third of the mentions.

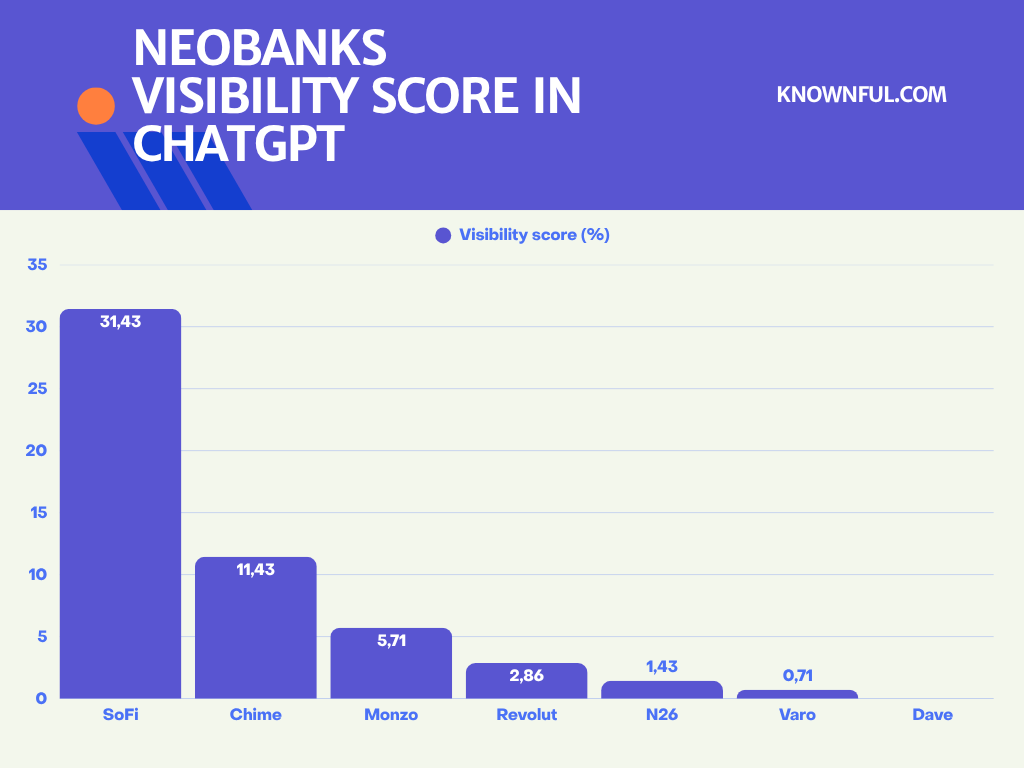

Finding #4: the neobanks surprise (they’re behind)

This was the finding that shocked me most.

Remember all the hype about neobanks being “digital natives”? About how they’d disrupt traditional banking with their tech-first approach?

The data tells a different story.

Wait, what?

Putting Neobanks performance in context

The 28.86% visibility gap between traditional banks and neobanks deserves nuance.

The 140 keywords analyzed span 13 diverse categories—many of which naturally favor established players. Business banking, mortgages, and general banking queries tend to reward decades of content and brand recognition. Neobanks were never built to compete in these categories.

Where the gap narrows:

In the “online banking” category—where neobanks should theoretically dominate—the picture improves but remains concerning:

- Revolut: 36.36% visibility

- N26: 18.18% visibility

These scores show that international neobanks can achieve meaningful visibility in their core category. But they’re still far from the 81-91% that top performers (SoFi, Capital One, Ally, Chime) achieve in the same category.

The visibility opportunity for neobanks

Based on the data, I could recommend a clear path forward:

- Expand content coverage: Most neobanks focus narrowly on their core product. Covering adjacent intent clusters (savings strategies, banking comparisons, financial education) would increase touchpoints with AI training data.

- Build editorial authority: Creating dedicated content hubs around specific banking topics gives AI models more material to reference.

- Invest in PR and brand mentions: AI learns from what’s written about you, not just what you write. Strategic PR campaigns that generate coverage on authority sites that are AI sources (especially NerdWallet and Bankrate) directly impact AI visibility.

The underlying challenge

Traditional banks didn’t deliberately optimize for AI visibility—they built it through 20+ years of content, PR, and SEO. Neobanks are 5-10 years old with narrower content footprints.

But here’s the advantage: neobanks are more agile. They can build AI visibility deliberately and faster than legacy institutions can adapt.

The 20% average visibility isn’t a ceiling—it’s a starting point. But only for neobanks that treat AI visibility as a strategic priority, not an afterthought.

If you’re leading marketing or growth at a neobank and want to discuss strategies to improve your AI visibility, feel free to reach out.

Contact me →

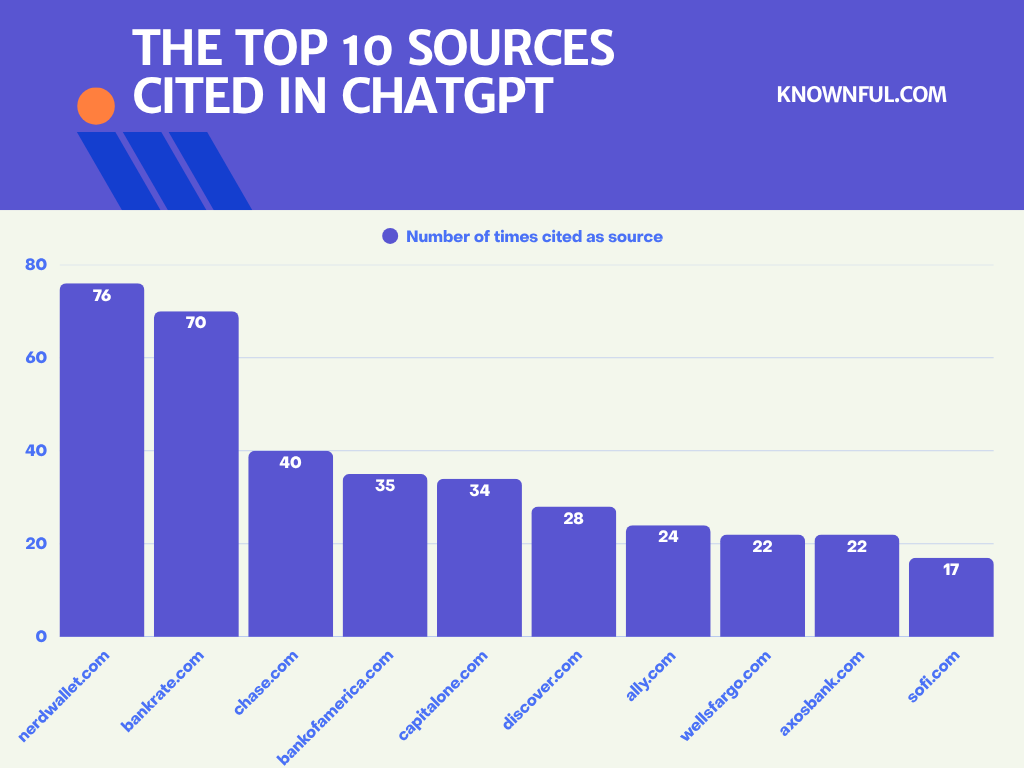

Finding #5: 2 websites dominate AI sources

When I extracted the sources AI cited, one pattern became impossible to ignore:

NerdWallet: 76 mentions (15,64% of all sources) Bankrate: 70 mentions (14.4% of all sources)

Combined: 146 mentions = 30% of all AI sources

Two websites. One-third of AI’s banking knowledge.

The top 10 websites sources

Here’s where AI learns about banks:

- NerdWallet.com (76 mentions)

- Bankrate.com (70 mentions)

- Chase.com (40 mentions)

- BankOfAmerica.com (35 mentions)

- CapitalOne.com (34 mentions)

- Discover.com (28 mentions)

- Ally.com (24 mentions)

- WellsFargo.com (22 mentions)

- AxosBank.com (22 mentions)

- SoFi.com (17 mentions)

Notice the pattern: Comparison/informational sites rank #1 and #2, then bank websites.

Strategic implication: If you want AI to recommend you, make sure that you are getting featured well on comparison sites.

What this means for banks

If you work at a traditional Bank

Your advantage is temporary.

Right now, you’re winning because of historical content and brand recognition. But that advantage erodes with every new training data update.

What you should do:

- Don’t get complacent — Monitor your AI visibility quarterly

- Invest in fresh content — AI models love recent, comprehensive information

- Own specific categories — Even Chase doesn’t dominate everywhere

- Double down on comparison sites — That’s where AI learns

If you work at a neobank

You currently have half the AI visibility of traditional banks.

What you should do:

- Get on comparison sites — Aggressively pursue NerdWallet and Bankrate placement and expand

- Content explosion — 10x your content output, especially educational content

- Move fast — You’re more agile than big banks. Use it.

If you’re at a regional bank

Many regional banks with billions in assets have a small AI visibility. When Gen Z asks ChatGPT for recommendations, you don’t exist.

What you should do:

- Focus geographically — Own “best bank in [your region]” content

- Get listed — Increase your PR actions

- Build content — You need searchable, helpful content at scale

One Analysis, countless strategic insights

What started as a question about AI recommendation patterns became a comprehensive study of how brands exist—or don’t exist—in the AI-powered future.

The 27% of banks with zero visibility aren’t small players. They’re established institutions with millions of customers.

The traditional banks dominating today aren’t guaranteed winners tomorrow. Their advantage is based on historical content, not deliberate AI strategy.

The neobanks currently losing have time to adapt. They’re more agile and can move faster than legacy players.

As AI-powered search becomes mainstream, the cost of invisibility compounds.

At Knownful, we’re tracking this shift across industries—helping brands understand where they stand and how to adapt before it’s too late.

Want your private brand’s AI visibility analysis?

Using the same systematic methodology that powered this banking study, Knownful can analyze your brand’s visibility in ChatGPT.

Contact me →

What you will receive:

📹 10-minute video walkthrough

I will explain your results, show where you stand vs. competitors, and highlight the key patterns in the data.

📊 Complete Excel dataset

- Top URLs cited: Specific pages and sources driving AI responses

- Summary tab: Key findings and visibility scores at a glance

- Full data tab: Complete ChatGPT responses for each keyword, with all brand mentions and sources cited

- Overall visibility scores: Your brand vs. competitors—mention frequency and visibility ranking

- Category breakdown: Visibility scores and mention counts by keyword category (e.g., product types, use cases)

- Top domains cited: Which websites ChatGPT references most frequently in your industry

Limited capacity: to ensure quality and depth.

About Knownful & this research

Knownful is a platform and media dedicated to tracking and analyzing brand visibility across AI models. This case study showcases our methodology applied to the American banking sector.

Our approach combines:

- Systematic AI query analysis across multiple categories

- Source attribution tracking to understand where AI learns

- Competitive benchmarking at scale

- Actionable recommendations for visibility improvement

This banking analysis represents our inaugural deep dive. Future studies will cover additional industries as AI-powered search continues to reshape brand discovery.

Research Transparency:

- No conflicts of interest: no brands paid for inclusion or exclusion

- Methodology: fully documented throughout this report

Questions about methodology or findings? Want to discuss your brand’s AI visibility strategy?

Share This Research:

Found this valuable? Help others discover how AI is reshaping brand visibility.